All Categories

Featured

Table of Contents

For most individuals, the biggest trouble with the boundless banking concept is that first hit to early liquidity triggered by the prices. Although this con of unlimited banking can be reduced substantially with appropriate plan style, the initial years will certainly always be the worst years with any kind of Whole Life policy.

That said, there are particular unlimited financial life insurance coverage policies designed mostly for high very early money value (HECV) of over 90% in the initial year. The long-term efficiency will certainly commonly considerably lag the best-performing Infinite Financial life insurance policy plans. Having access to that extra four figures in the very first few years might come at the expense of 6-figures down the road.

You actually obtain some significant lasting advantages that assist you redeem these very early prices and after that some. We discover that this impeded very early liquidity issue with infinite financial is more mental than anything else once thoroughly discovered. As a matter of fact, if they definitely required every dime of the cash missing out on from their limitless financial life insurance coverage policy in the first few years.

Tag: limitless financial principle In this episode, I talk regarding finances with Mary Jo Irmen that teaches the Infinite Financial Concept. With the increase of TikTok as an information-sharing system, economic advice and approaches have discovered an unique means of spreading. One such strategy that has actually been making the rounds is the limitless financial idea, or IBC for brief, amassing recommendations from stars like rapper Waka Flocka Flame.

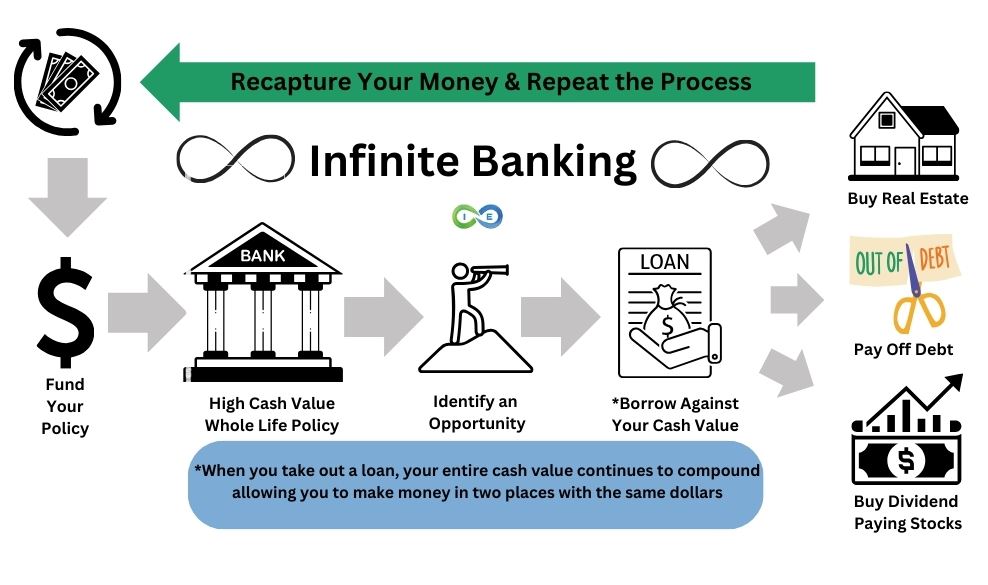

Within these plans, the cash money value expands based on a price established by the insurance company. When a significant cash money worth builds up, insurance holders can obtain a money value finance. These fundings differ from conventional ones, with life insurance acting as security, meaning one could shed their protection if borrowing excessively without sufficient cash value to sustain the insurance coverage expenses.

And while the allure of these plans appears, there are innate restrictions and dangers, demanding diligent cash worth surveillance. The approach's legitimacy isn't black and white. For high-net-worth people or company proprietors, specifically those using techniques like company-owned life insurance policy (COLI), the advantages of tax obligation breaks and substance growth might be appealing.

Infinite Banking Center

The attraction of unlimited banking doesn't negate its challenges: Expense: The foundational need, a permanent life insurance coverage plan, is costlier than its term equivalents. Eligibility: Not everybody gets approved for entire life insurance policy as a result of extensive underwriting procedures that can exclude those with details health or way of life problems. Complexity and risk: The elaborate nature of IBC, combined with its dangers, might deter numerous, specifically when simpler and less risky options are readily available.

Assigning around 10% of your month-to-month revenue to the plan is simply not feasible for many people. Part of what you read below is just a reiteration of what has actually already been claimed above.

Prior to you obtain yourself right into a circumstance you're not prepared for, know the adhering to initially: Although the principle is typically sold as such, you're not actually taking a funding from yourself. If that were the situation, you would not need to repay it. Instead, you're borrowing from the insurance provider and have to settle it with interest.

Some social media sites posts advise making use of cash worth from whole life insurance policy to pay for charge card financial debt. The idea is that when you settle the lending with passion, the amount will be returned to your investments. That's not just how it functions. When you pay back the financing, a section of that rate of interest goes to the insurance provider.

For the first several years, you'll be paying off the compensation. This makes it very hard for your plan to collect worth throughout this moment. Entire life insurance policy prices 5 to 15 times a lot more than term insurance policy. Many individuals merely can't manage it. So, unless you can afford to pay a few to numerous hundred bucks for the next years or more, IBC will not benefit you.

Infinite Banking Concept Dave Ramsey

If you call for life insurance policy, below are some valuable tips to take into consideration: Consider term life insurance policy. Make sure to go shopping about for the best price.

Copyright (c) 2023, Intercom, Inc. () with Booked Typeface Call "Montserrat". This Font style Software application is accredited under the SIL Open Typeface Certificate, Version 1.1. Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Booked Typeface Name "Montserrat". This Font Software application is licensed under the SIL Open Font Permit, Variation 1.1.Skip to major content

Ibc Finance

As a CPA specializing in real estate investing, I've brushed shoulders with the "Infinite Banking Principle" (IBC) a lot more times than I can count. I've also interviewed professionals on the topic. The major draw, apart from the noticeable life insurance policy advantages, was always the idea of building up cash money value within an irreversible life insurance policy plan and loaning versus it.

Sure, that makes good sense. Truthfully, I always thought that money would be better spent directly on investments instead than channeling it via a life insurance plan Up until I uncovered exactly how IBC might be incorporated with an Irrevocable Life Insurance Count On (ILIT) to develop generational wide range. Allow's begin with the fundamentals.

Infinite Banking Center

When you borrow against your plan's cash money worth, there's no collection payment timetable, giving you the freedom to handle the finance on your terms. Meanwhile, the cash money worth remains to grow based on the plan's warranties and dividends. This arrangement enables you to access liquidity without interfering with the long-lasting growth of your plan, offered that the car loan and rate of interest are taken care of sensibly.

As grandchildren are birthed and grow up, the ILIT can purchase life insurance coverage plans on their lives. Household members can take lendings from the ILIT, using the money value of the plans to money investments, begin businesses, or cover significant expenses.

An important element of managing this Family Bank is the use of the HEMS requirement, which means "Health and wellness, Education And Learning, Upkeep, or Support." This standard is often consisted of in trust fund arrangements to direct the trustee on how they can distribute funds to beneficiaries. By sticking to the HEMS requirement, the trust fund guarantees that distributions are created important demands and lasting support, guarding the trust fund's properties while still attending to relative.

Enhanced Adaptability: Unlike rigid small business loan, you manage the settlement terms when borrowing from your own plan. This allows you to structure settlements in such a way that lines up with your organization cash flow. the infinite banking concept. Enhanced Capital: By financing service expenditures via plan loans, you can possibly maximize cash that would certainly or else be bound in conventional finance payments or devices leases

He has the very same tools, yet has actually additionally constructed additional money value in his policy and obtained tax obligation advantages. And also, he now has $50,000 available in his policy to use for future opportunities or costs. Regardless of its possible benefits, some people stay unconvinced of the Infinite Financial Idea. Allow's resolve a couple of usual concerns: "Isn't this just costly life insurance policy?" While it's true that the costs for an effectively structured whole life policy might be more than term insurance, it is essential to view it as greater than simply life insurance policy.

Concept Of Banking

It's about creating an adaptable funding system that provides you control and gives several benefits. When made use of purposefully, it can enhance various other financial investments and business strategies. If you're captivated by the possibility of the Infinite Banking Idea for your organization, right here are some actions to consider: Inform Yourself: Dive much deeper into the principle through reputable publications, seminars, or examinations with knowledgeable specialists.

Table of Contents

Latest Posts

Infinite Banking Course

Byob

What Is Infinite Banking

More

Latest Posts

Infinite Banking Course

Byob

What Is Infinite Banking